What Does It Mean When You Refinance A Car

Refinancing a car is the process of having your auto loan paid off and replaced with a new one usually with a different lender with new agreed-upon terms. In practice auto refinancing is the process of paying off your current car loan with a new one usually from a new lender.

How To Refinance Your Car Loan Good Credit Car Loans Refinance Car

Maybe your credit has improved and you might qualify for a lower interest rate or your financial situation has gotten better and you want to remove the co-signer from your original loan.

What does it mean when you refinance a car. When you refinance your car you take on a new loan to pay off the balance on your current car loan. The ability to borrow at a lower interest rate is a primary reason to refinance a loan. Refinancing your car loan can have some or all of the following benefits.

The finer details of a refinancing can. Refinancing simply means that you pay off your current car loan with a new loan. The benefits of refinancing a car include getting a lower interest rate to reduce your monthly payments or a shorter loan term.

Curious as to why. Refinancing is the act of borrowing money to pay off a current car loan. Refinancing an auto loan essentially means youre replacing your current loan with a new one ideally with better terms.

Refinancing your car Refinancing is when you replace an existing loan repayment plan with a new one. Keep reading to find out. Refinancing and extending your loan term can lower your payments and keep more money in your pocket each month but you may pay more in interest in the long run.

This process can have varying outcomes for car owners. The new loan should ideally have better terms or features that improve your finances to make the whole process worthwhile. Because the interest rate is also part of your monthly payment calculation your required payment should also decrease.

Refinancing an auto loan means replacing your current car loan with a new one. The refinanced loan is a fresh contract typically with another lender that gives you the chance to agree to different terms. There are various possible outcomes and in many cases its about saving money or otherwise finding a more affordable loan.

Your new auto loan pays off the old one meaning youll have an all-new loan agreement including a new APR which is your interest rate and a new loan term which is the amount of time you have to pay off the loan. If a borrower is in danger of defaulting on their debt a restructured auto loan agreement can be helpful for getting their finances back on track. Refinancing is a great option for those who initially took out a bad credit car loan with a high interest rate.

Most car owners choose to refinance their loan to lower their monthly payments. The old lender will release its lien over the vehicle and the new lender will take a lien instead. Depending on your situation auto refinancing could lower your interest rate your monthly payment or change the duration of your loan.

Refinancing a car is the process of taking out a new loan to replace an existing note. On the other hand refinancing to a lower interest rate at the same or shorter term as you have now will help you pay less overall. Were going to talk you through the pros and cons of refinancing a car and the cost to your wallet and credit.

That lower rate assuming all other factors are equal means you pay less for your car after taking all of your borrowing costs into account. Refinancing your car can be helpful in some situations. If you have improved your credit score since you first took out a car loan as you may have access to better interest rates.

If you need to save money immediately whether to free up cash for an emergency expense or because of a sudden drop in income. In many cases the borrower will refinance to save money on interest or get a more comfortable monthly payment. In order to refinance youll need a lender thats willing to work with you.

There are many reasons people do this and whether its a beneficial or damaging move for you will depend on a multitude of factors. You may be able to get a lower interest rate on your car finance You may be able to lower your monthly loan installments You may be able to pay off the balance of your car loan quicker. When you refinance a car you replace your current car loan with a new loan of different terms.

Refinancing involves replacing an existing loan with a new loan that pays off the debt of the first one. When you refinance a car loan youre essentially replacing your old loan with a new one usually with better terms.

The Upcoming Trends In Pickup Trucks Car Loans New Trucks Pickup Trucks

Awesome Getting A Car Loan With No Credit History People Euro Media Check More At Http Ukreuromedia Com En Pin 3245 Car Loans Car Insurance Credit History

What Does Your Credit Score Mean For Refinancing Auto Loans Schedule An Appointment With Prime Credit Advisors To In Car Loans Loans For Bad Credit Get A Loan

What Is Cash Out Refinancing Of An Auto Loan Credit Karma

Refinance Your Car Loan Keep Your Car Dcu

When Should I Refinance My Auto Loan Credit Karma

Leasing Vs Financing A Car Valley Auto Loans Car Buying New Cars Used Cars Online

Pin By Maria Volkova On Car Auto Car Buying Car Dealer

Refinancing An Auto Loan To Save Money Car Loans Loan Saving Money

Heraldeecreates Home Making Life Colorful One Page At A Time Financial Planning Printables Budgeting Money Mutual Funds Investing

Mexico Car Rental Market Analysis By Knowledge Sourcing Intelligence Car Loans Refinance Car Car Finance

Home Loan Refinance Calculator Should I Refinance Save Amount Mortgage Refinance Calculator Refinance Calculator Refinance Mortgage

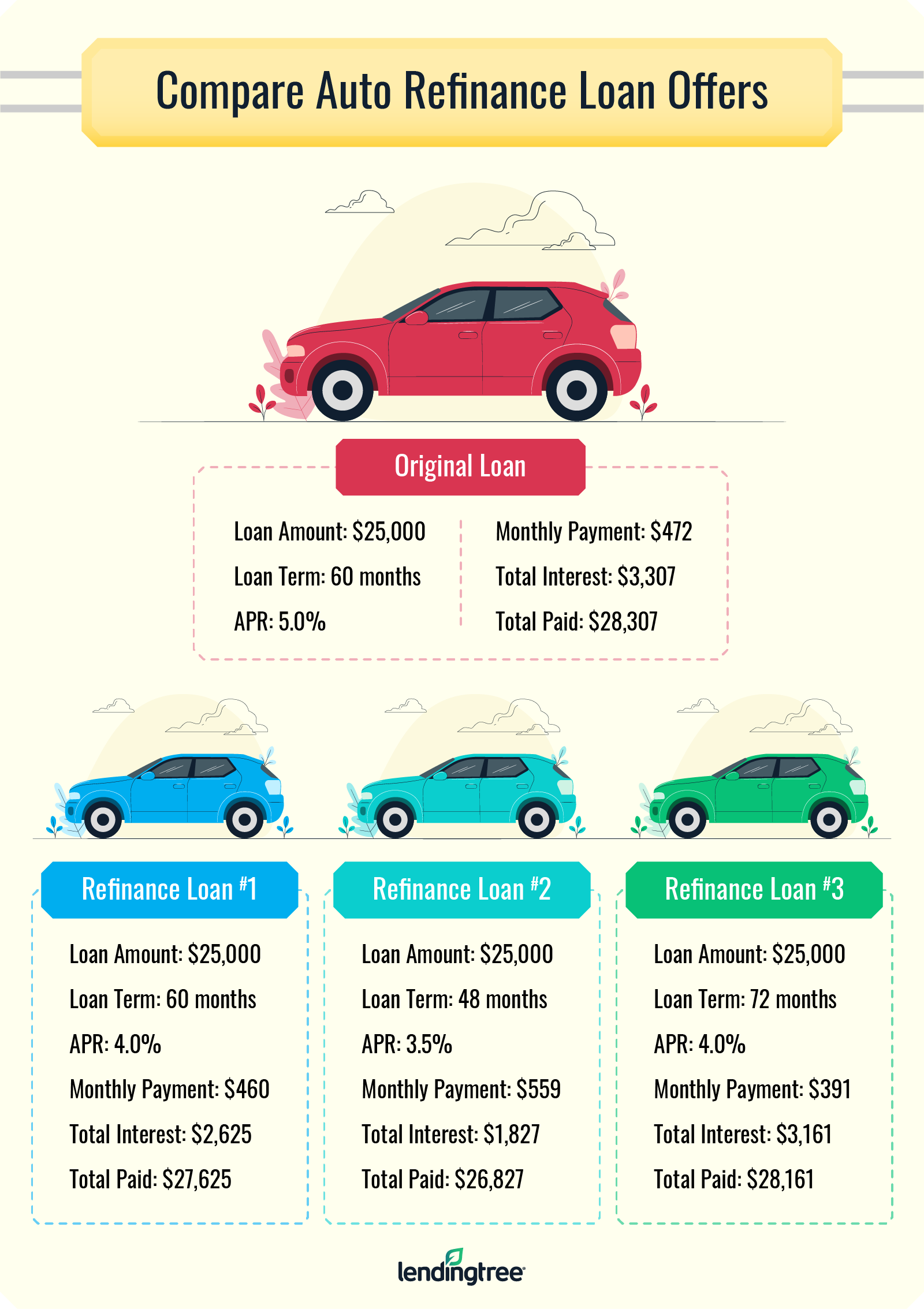

How To Refinance A Car Loan In 6 Steps Lendingtree

Refinancing A Car Loan With A 500 Credit Score Bad Credit Self

Things To Remember Before Singing Up For A Bad Credit Car Loan Home Renovation Loan Loans For Bad Credit Home Improvement Loans

Do You Get Cash If You Refinance Your Auto Loan

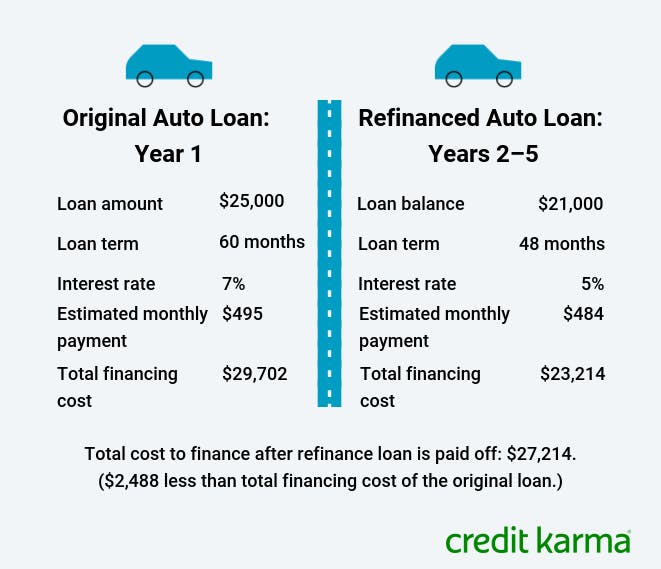

When Does Refinancing A Car Loan Make Sense Credit Karma

Post a Comment for "What Does It Mean When You Refinance A Car"